PHILOSOPHY

Underpinning Lorica’s investment philosophy is a belief that value can be added through active management in all market environments.

We believe a comprehensive range of core bond market competencies, including yield curve and corporate bond analysis, can be used effectively to manage fixed income investments within a central risk management paradigm.

Economies and markets are dynamic and we have learned they call for an adaptive, subjective approach to forecasting.

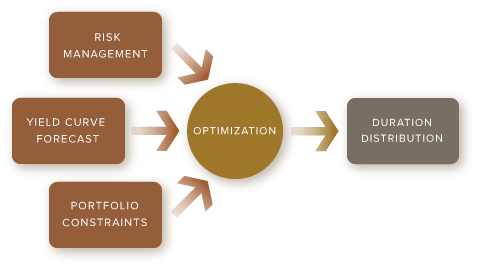

However, construction of diversified, yet targeted portfolios is ideally suited to our proprietary computer-based models and algorithms. Finally, our active process of managing portfolios involves consideration of a client’s constraints and desired level of risk.

INVESTMENT PROCESS

Active investing along the yield curve is as much art as it is science. In today’s complex and constantly changing markets, forecasting yields has become somewhat of an art form.

No simple econometric model or relationship has the power to predict changes to the yield curve. We rely on analysis of fundamental and technical factors affecting the economy and the bond market to forecast changes to the shape and level of the yield curve.

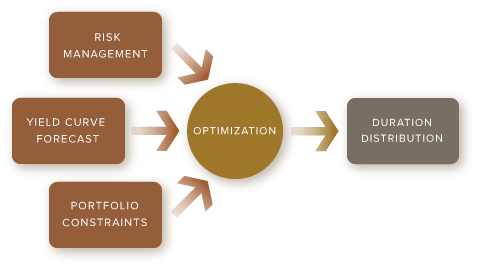

Translating that forecast into portfolios that will generate superior performance, can rely more on science – we use proprietary computational tools to derive optimal portfolio structures.

Our active process of managing the duration of a portfolio involves consideration of a clients constraints and desired level of risk.

YIELD CURVE

In today’s complex and constantly changing market environment, managing to changes in bond yields across different maturities – the yield curve, requires attention to a wide variety of factors.

At Lorica, we rely on analysis of fundamental, technical and non-systematic factors affecting economies and bond markets to forecast changes to the shape and level of the yield curve. We begin with our expectations for real yields and inflation, which are then aggregated to form our forecast for nominal yields. Translating our forecast into portfolios, that will generate superior performance, involves construction of optimal portfolios through extensive use of our proprietary computer models, and tactical trade execution.

CREDIT ANALYSIS

Corporate bond management is an integral component of Lorica’s investment process.

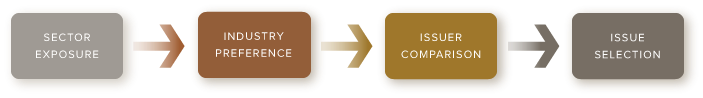

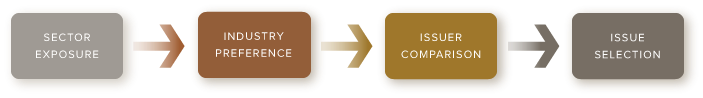

We begin with an examination of the corporate bond market through an examination of fundamental, technical and non-systematic factors. We determine the optimal corporate bond exposure in terms of duration, yield curve positioning, and market value. From there we employ a systematic approach looking at both fundamental and quantitative factors to determine desirable industries and issuers. Selection of specific securities requires close examination of bond specific’s including placement on the capital structure, issue size, market support and maturity. Although our overall approach can be thought of as top-down, actual implementation can be seen very much as bottom-up, relating to market opportunity, liquidity and timing.

PHILOSOPHY

Underpinning Lorica’s investment philosophy is a belief that value can be added through active management in all market environments.

We believe a comprehensive range of core bond market competencies, including yield curve and corporate bond analysis, can be used effectively to manage fixed income investments within a central risk management paradigm.

Economies and markets are dynamic and we have learned they call for an adaptive, subjective approach to forecasting.

However, construction of diversified, yet targeted portfolios is ideally suited to our proprietary computer-based models and algorithms. Finally, our active process of managing portfolios involves consideration of a client’s constraints and desired level of risk.

INVESTMENT

PROCESS

Active investing along the yield curve is as much art as it is science. In today’s complex and constantly changing markets, forecasting yields has become somewhat of an art form.

No simple econometric model or relationship has the power to predict changes to the yield curve. We rely on analysis of fundamental and technical factors affecting the economy and the bond market to forecast changes to the shape and level of the yield curve.

Translating that forecast into portfolios that will generate superior performance, can rely more on science – we use proprietary computational tools to derive optimal portfolio structures.

Our active process of managing the duration of a portfolio involves consideration of a clients constraints and desired level of risk.

YIELD CURVE

In today’s complex and constantly changing market environment, managing to changes in bond yields across different maturities – the yield curve, requires attention to a wide variety of factors.

At Lorica, we rely on analysis of fundamental, technical and non-systematic factors affecting economies and bond markets to forecast changes to the shape and level of the yield curve. We begin with our expectations for real yields and inflation, which are then aggregated to form our forecast for nominal yields. Translating our forecast into portfolios, that will generate superior performance, involves construction of optimal portfolios through extensive use of our proprietary computer models, and tactical trade execution.

CREDIT ANALYSIS

Corporate bond management is an integral component of Lorica’s investment process.

We begin with an examination of the corporate bond market through an examination of fundamental, technical and non-systematic factors. We determine the optimal corporate bond exposure in terms of duration, yield curve positioning, and market value. From there we employ a systematic approach looking at both fundamental and quantitative factors to determine desirable industries and issuers. Selection of specific securities requires close examination of bond specific’s including placement on the capital structure, issue size, market support and maturity. Although our overall approach can be thought of as top-down, actual implementation can be seen very much as bottom-up, relating to market opportunity, liquidity and timing.