YIELD CURVE

In today’s complex and constantly changing market environment, managing to changes in bond yields across different maturities – the yield curve, requires attention to a wide variety of factors.

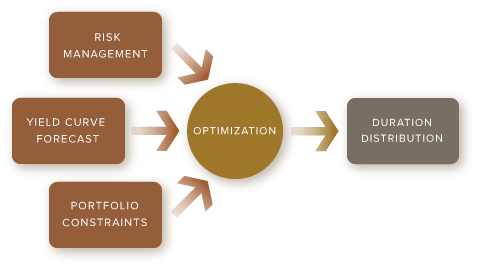

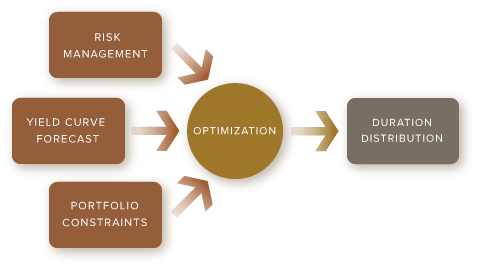

At Lorica, we rely on analysis of fundamental, technical and non-systematic factors affecting economies and bond markets to forecast changes to the shape and level of the yield curve. We begin with our expectations for real yields and inflation, which are then aggregated to form our forecast for nominal yields. Translating our forecast into portfolios, that will generate superior performance, involves construction of optimal portfolios through extensive use of our proprietary computer models, and tactical trade execution.

YIELD CURVE

In today’s complex and constantly changing market environment, managing to changes in bond yields across different maturities – the yield curve, requires attention to a wide variety of factors.

At Lorica, we rely on analysis of fundamental, technical and non-systematic factors affecting economies and bond markets to forecast changes to the shape and level of the yield curve. We begin with our expectations for real yields and inflation, which are then aggregated to form our forecast for nominal yields. Translating our forecast into portfolios, that will generate superior performance, involves construction of optimal portfolios through extensive use of our proprietary computer models, and tactical trade execution.

LORICA

Fixed Income Specialist

Funds, Seg. Acts. and UMA/SMA

100% Employee-Owned

SITE MAP

Who We Are - How We Invest

Our Strategies - Our Platforms

Where to Find Us

LORICA

Fixed Income Specialist

Funds, Seg. Acts. and UMA/SMA

100% Employee-Owned

SITE MAP

Who We Are - How We Invest

Our Strategies - Our Platforms

Where to Find Us